- Tax Relief Targets Middle Class and Retirees

- Education Funding Increases Despite Republican Opposition

- Political Dynamics Shape Final Passage

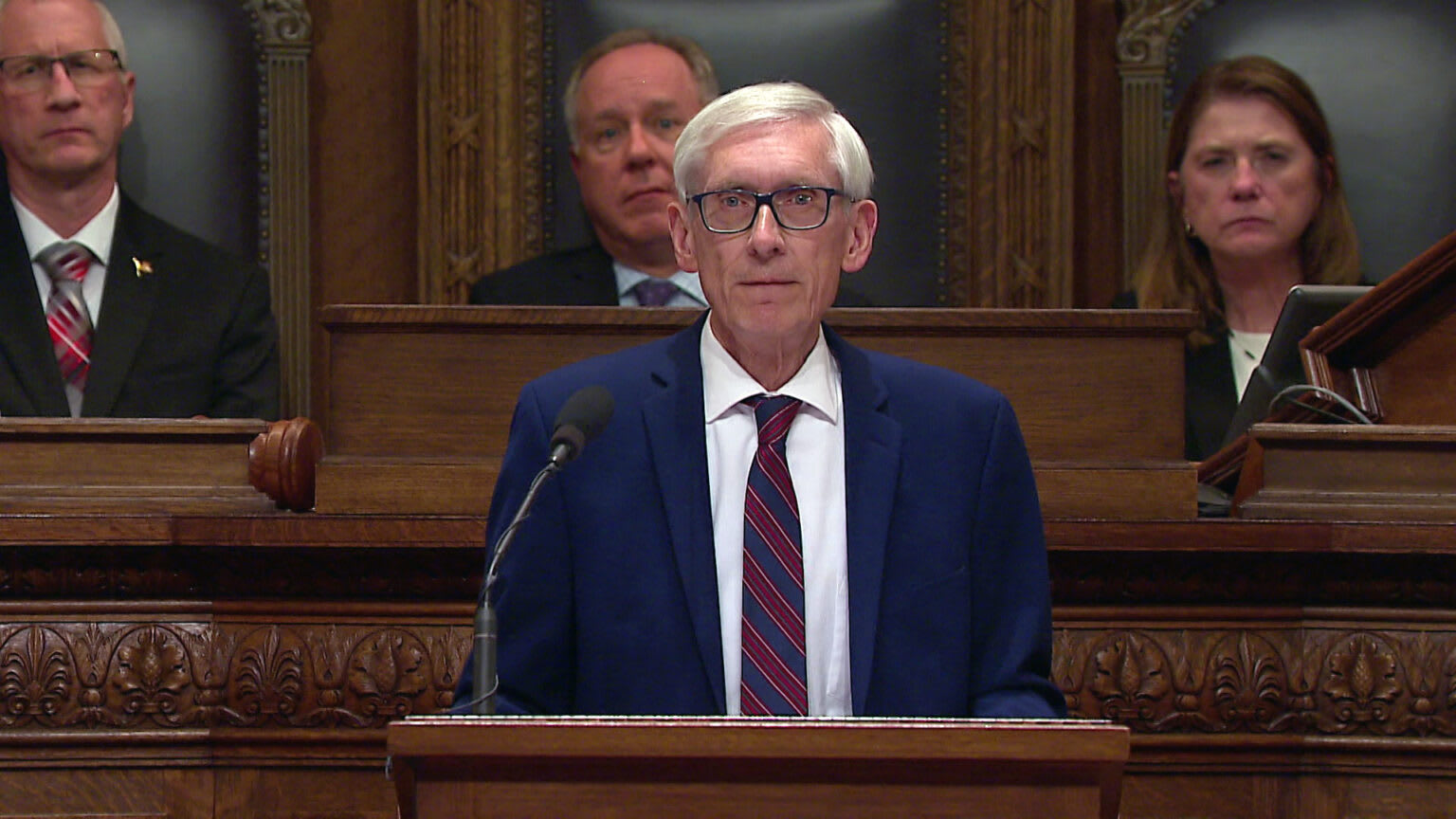

Wisconsin Democratic Gov. Tony Evers and Republican legislative leaders announced a bipartisan budget deal Tuesday that delivers $1.3 billion in income tax cuts while boosting funding for public schools, universities and child care programs.

The agreement, reached one day after the state's budget deadline, would cut taxes for more than 1.6 million Wisconsin residents by an average of $180 annually, with 82 percent of the relief going to taxpayers earning less than $200,000.

The tax package expands Wisconsin's second-lowest income tax bracket and creates new retirement income exemptions12. Residents age 67 and older could exclude up to $24,000 of retirement income from state taxes, or $48,000 for married couples filing jointly, affecting approximately 280,000 filers with average savings of $1,000 each34.

The deal also eliminates sales tax on residential electricity, saving taxpayers about $156 million over two years12. Combined with the income tax cuts, the provisions would reduce Wisconsin's individual income tax burden by more than $600 million annually3.

Evers secured nearly $1.4 billion in spending revenue for K-12 schools, including what his office called the largest increase to special education reimbursement in state history1. The agreement provides $500 million for K-12 special education programs and represents the largest University of Wisconsin System investment in over two decades21.

The deal allocates more than $330 million for Wisconsin's child care industry, including direct payments to providers that Evers had identified as essential to avoiding a budget veto1. State employees, including university staff, would receive 3 percent raises this year and 2 percent next year23.

The agreement emerged after Republicans eliminated more than 600 of Evers' original proposals, including marijuana legalization, Medicaid expansion and tax increases on millionaires12. Republicans hold an 18-15 Senate majority, but with two GOP senators previously indicating opposition to the budget, Democratic votes may be needed for passage12.

Assembly Speaker Robin Vos praised the deal as delivering "tax relief for Wisconsin and reforms to make government more accountable," according to WisPolitics3. Senate Minority Leader Dianne Hesselbein said Democratic participation in negotiations "made the agreement better"3.

The Legislature's budget committee votes Tuesday, with full legislative action expected Wednesday12. Evers has indicated he would not veto provisions included in the negotiated agreement2.