- Industry Recovery and Immediate Impact

- Competing Against Georgia and New York

- Criticism and Broader Changes

California Gov. Gavin Newsom signed legislation Wednesday more than doubling the state's annual film and television tax credit program to $750 million, marking the largest expansion of Hollywood production incentives in the state's history as the industry struggles to recover from strikes, wildfires and heightened competition from other states.

The new law increases the program's cap from $330 million annually and is projected to generate $664 million in economic activity while creating 6,500 jobs for cast and crew across the state. The signing comes exactly six months after the Palisades and Eaton wildfires devastated parts of Los Angeles, with new applications opening Monday as the entertainment capital works to rebuild.

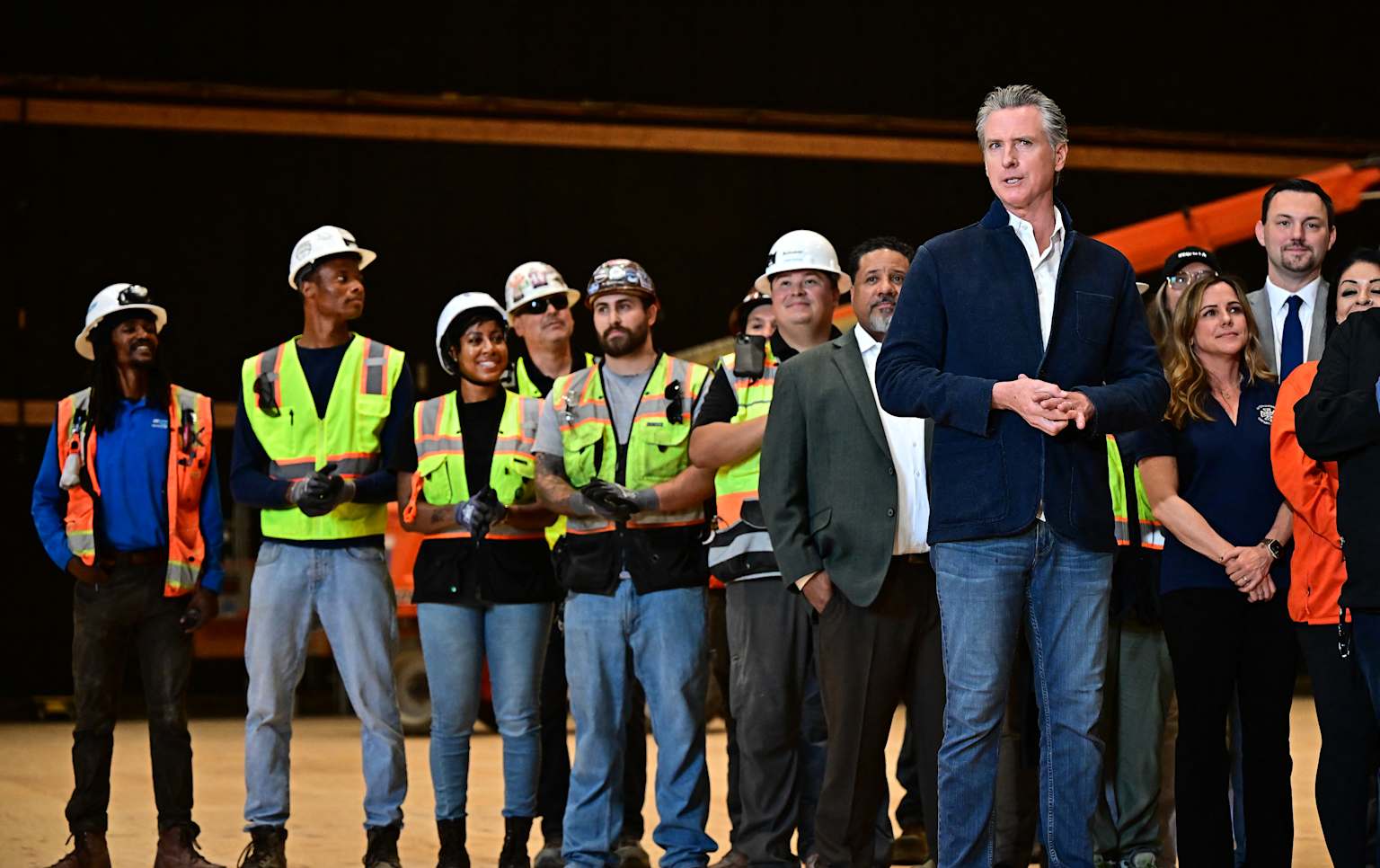

Flanked by Los Angeles Mayor Karen Bass and union representatives, Newsom said the state "needed to make a statement and to do something that was meaningful" to prevent productions from leaving California1. The governor acknowledged the state had "put our feet up, took things for granted" in the face of mounting competition1.

Forty-eight projects have already been approved under the expanded program, with more than half scheduled to film in the Los Angeles area2. The approved slate includes 43 independent features and five studio projects, with productions ranging from an Issa Rae project to a film directed by Ang Lee34.

"You understand that our industry is vital to the state's economy and cultural vibrancy, while also sustaining thousands of businesses and attracting visitors from around the world," said Rebecca Rhine, Directors Guild of America executive and Entertainment Union Coalition president, during the signing ceremony1.

California's increase responds to aggressive competition from other states offering film incentives. Georgia provides unlimited tax credits and has extended more than $5 billion since 2015, while New York has provided at least $7 billion in credits1. According to The New York Times, 38 states now offer some form of filming incentive, with states providing more than $25 billion in total over the past two decades1.

The legislation aims to position California as more competitive nationally, though it still trails Georgia's unlimited program.

Critics and taxpayer advocates have called the program a corporate giveaway that doesn't generate promised economic returns1. The expansion comes as California faces budget constraints and federal funding cuts following the recent wildfires.

A separate bill working through the legislature would broaden eligible productions to include animated films and competition shows, while increasing tax credits to as much as 35% for Los Angeles-area productions and 40% for projects shot elsewhere in the state12.

"Now, let's get people back to work," Rhine said1.